It’s (almost) a new year. Time to turn over a new leaf. For me, and I’d imagine many of us, that means time to get organized!

Over the past several weeks, I’ve been focusing on financial organization.

As we have moved more and more of our financial life online, I’ve found that our old-school spread sheets haven’t been keeping up. Plus, tracking our business expenses is getting increasingly complicated, with the growth of the blog and freelance projects on the side.

Back in December, I shared with you my initial foray into Mint.com, a FREE online budgeting system. Basically, I signed up, got started… and then, got distracted.

Instead of laying the necessary foundation to really make Mint work for me, I just reverted to my old Excel charts.

Two months ago, a reader and friend (Hi, Becky!) reminded me how much she loves Mint. Her enthusiastic endorsement convinced me to take a second look.

Over the past two months, I have spent no more than a few minutes each week updating my accounts, labeling transactions and generally fine-tuning things over on Mint.com.

With this tiny bit of maintenance, I have seen the power of Mint and I’m loving it! (I’m not gonna lie – the fact that it’s totally sleek and pretty doesn’t hurt either.)

For the uninitiated, Mint.com is a FREE online budgeting system, which helps you to track spending, savings, debt repayment and more. In a nutshell, it makes organizing and managing your money a whole lot easier.

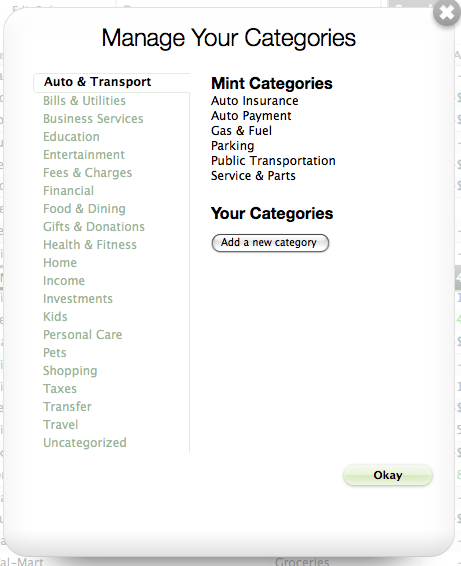

You just link up all your accounts – checking, savings, credit cards and debit cads – and then Mint.com pulls and categorizes your transactions. If Mint’s pre-set categories don’t work for you, you can delete, change or add them.

It’s taken me a few weeks of playing with it, but the categories now match up to our budget categories. For example, as you know, we have one line item in our budget for food, household items and toiletries.

I don’t want my spending separated out into personal care, household, groceries, and the occasional restaurant treat (Starbucks). I just want to see if I’ve exceed my $500 total budget. With just a few minutes of categorizing instruction from me, Mint now knows to automatically lump all that spending together into “food”.

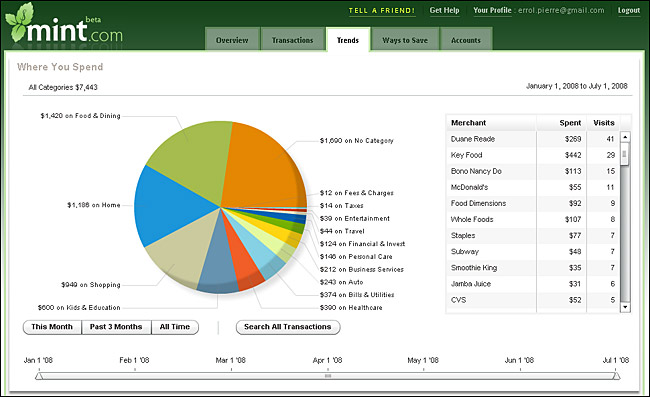

(These are not my personal trends, but rather a stock image from the Mint.com blog that demonstrates how the trends feature works.)

(These are not my personal trends, but rather a stock image from the Mint.com blog that demonstrates how the trends feature works.)

Speaking of which, not only can you personalize the categories for your transactions, you can also pull “Trends” – which look at how your spending in any given category has fluctuated over the past number of months. So let’s say food. I can see how much I’ve spent on food every month since I opened my Mint.com account.

And then I can further break down that trend to see how much I’m spending at Whole Foods vs. Costco vs. Walmart. Pretty cool, huh? (Yes, Costco is my weak link.) Think that Starbucks habit is costing you “just a few dollars a month”? Mint.com’s Trends feature might prove otherwise!

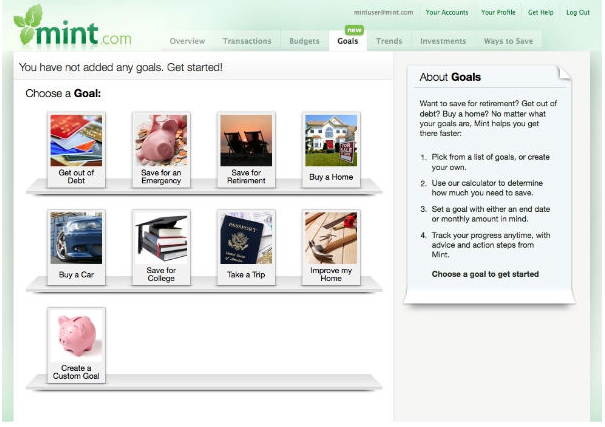

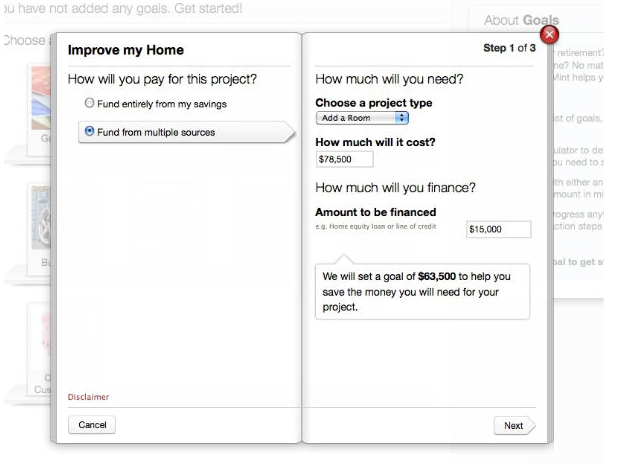

Another popular feature is the ability to set up goals – and then TRACK your progress. Want to pay off your credit card balance? Mint.com can help. Want to save for your child’s Bar Mitzvah. Mint.com will make sure you’re meeting your goal.

I also love that Mint.com gives you warnings when you have exceeded your budget in certain categories. Typically, my husband and I are quite careful about our spending. But occasionally we get our wires crossed and one of us will overspend. Mint.com makes sure we don’t totally blow it, by letting us know with a friendly email reminder.

Can you tell I’m convinced that Mint.com is helping me get organized for the new year?! If you’d like to give it a whirl, too, you can sign up for your FREE Mint.com account here.

If you do sign up, or if you’re already a Mint user, let me know what you think!

Can I make mint.com work for my Israeli budget?

I don’t see why not – it may not have the NIS symbol, but you can plug in your numbers and just disregard the $ sign. Let me know how it works out for you!

Mint is amazing. It’s gotten better lately (after a short rough period when it took over the bank connections and they weren’t working always) with the mobile abilities, too.

They are available in other countries but it really depends on the banks – that said, you would have trouble if you’re putting in in NIS and it’s calculating other stuff in dollars.

Oooh, that’s a good point, Ezzie.

I like mint, however, once we set (and reached) a goal, I couldn’t figure out how to show that the money we then spent was coming from that goal amount…

I tend to use the “Exclude from Mint” function a lot!